Bullzeye Trader presents the Best of Trade-Ideas!

http://bit.ly/TITOWBZ http://bit.ly/TradingRoomBZ http://bit.ly/TIDailyReCap http://bit.ly/TIWebArchTR http://bit.ly/AIHollyBZ http://bit.ly/TIPricing

Happy New Year !

John Kroner Sr. has been a business owner and/or manager for over 40 years and built his company Kroner Publications Inc. from the ground up.

Focusing on spreading good news and values throughout his home in Northeast Ohio, John is known for his integrity, love of the community and of business.

After many years in the day-to-day operations of his businesses he recently became involved with Equity Trading. After only a short time, he became obsessed with the possibilities.

One does not need employees, a large office or many of the other things needed to make money in standard businesses. In fact, you can trade with just your smart phone.

Not opposed to trying to help those with similar interests and love of the business world, John started Bullzeye Trader as a way to help share what he has learned and to develop a community of traders who share similar ideas.

Here is a recap of some of the tools that can help you no matter if you are an investor or a day or swing trader.

The Trade of the Week is intended as a swing trade,. selected by Professional Long Time Traders and you get entry, exit and target prices.

We'll Show You…

How we identified the trade of the week

Why we believe it will perform well based on the chart

The technical conditions that are in place for the stock at this time

How you can find more trades like the trade of the week on your own

Trade of the Week FREE at http://bit.ly/TITOWBZ

FREE TRADING ROOM with professional traders & screen sharing

WHY TRADE ALONE - Join a team, learn, profit & make new friends.......

Also, do not pay to be in a Trading Room when the best is FREE w/pro traders mentoring at http://bit.ly/TradingRoomBZ

Every day after the close, our Support Forum and Trading Chat Moderator, Barrie Einarson, posts a new video showing you the exact trades he engaged in during the day. http://bit.ly/TIDailyReCap

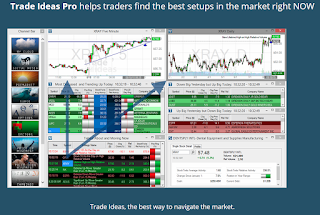

Some great products from Trade-Ideas: Artificial Intelligence, OddsMaker, Charts, Alert, Compare Count, Top List and Full quote windows to set the stage. See http://bit.ly/TIProductsBZ

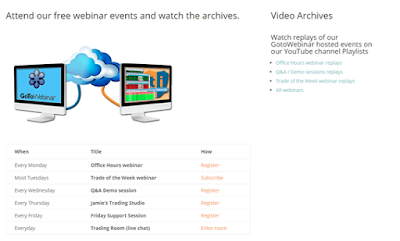

Our FREE webinars, daily Monday-Friday, review the market trends and help train you with this technology. All FREE at http://bit.ly/TIWebArchTR

How can Trade-Ideas Artificial Technology (AI) technology help you trade stocks?

WHAT MAKES ME UNIQUE:

After the market closes, I start looking at what happened today. How did today statistically affect the last 60 trading days? My AI splits the strategies up into at least 35 different concepts. Each one has a different purpose designed to help me beat the market.

I am looking at everything; long, short, cheap and expensive, fundamental, social, technical data and everything volume driven.

I take these 35 strategies and look at all the special Trade-Ideas filters to decide what I should modify to improve the outcome. After the initial Optimization process, I then teleport to Monte Carlo and redo everything again. Only then I know I am not fooling myself.

Only the strategies with a success rate above 60% and a 2:1 Profit Factor are visible to you the following day.

As the market becomes more challenging, less strategies are available and I will trade less as a result. Ultimately, I am always trading in the direction of least resistance.

Watching me trade is probably the simplest way to get instant value. Remember, I am like a card counting machine, but for the stock market. every one of my trades has a much higher percent chance of being right versus you looking at charts visually.

I also manage risk without emotion. each of my trades has a “smart” predefined exit. I only enter positions when all the numbers line up.

Much like a resident doctor will watch a seasoned surgeon operate, this is your opportunity to watch me dissect the market.

See http://bit.ly/AIHollyBZ for details.

Announcement: Planned Subscription Rate Increase in Q1 2018

NOTE: This policy is for NEW SUBSCRIPTIONS ONLY. Current subscribers will see no change in their prices.

Since Trade Ideas launched Holly our AI in 2016, we’ve reached a number of milestones, some of the more recent include: our AI is evolving and continues to beat the S&P and other indices, Idea Surfing, auto-trading for Interactive Brokerage via Brokerage+, improvements to chart visualization, addition of a Blockchain & Cryptocurrency channel, and adding Holly the AI to the web version of Trade Ideas.

We’ve grown our staff and capabilities to support a +300% increase in direct subscribers in just the last 2 years. The Trade Ideas development cycle is nimble, fast, agile, and iterates often.

In the past, we have only increased our subscription rates to reflect robust additions to the value and functionality of our services and technology to our subscribers, and the upcoming increase is no exception.

GRANDFATHERED RATES

Following the example we’ve set ourselves with past rate changes, existing subscriptions are grandfathered in at their current rates for as long as they remain active. We still have a significant number members paying around $40/month as they have maintained the same active subscriptions for many years. And you can do the same.

So, rather than have a regret like not buying a couple Bitcoins when they were under $1k, you should lock in the current 2017 rates for your Trade Ideas subscription. If you’re a current subscriber, congrats! Keep that subscription going to maintain the excellent rate.

FUTUREPROOF YOUR ALPHA

The date of the 20% increase is expected to be between late January and early February, the exact date is still to be determined. We’ll give plenty of notice.

Use the code BULLZEYE15 to save an instant 15% off your first month of Trade Ideas Premium or Trade Ideas Standard and you will be able to continue the 2017 rate for as long as your subscription is maintained.

Question? Send us an email at info@trade-ideas.com

Enjoy your Holidays and have a fantastic New Years! :-)

As always, If you are in the stock market or would like to be, please consider liking my page, and sharing with like minded people, https://www.facebook.com/BullzeyeTrader/ or following me on twitter at @BullzeyeTrader or follow my blog at BullzeyeTrader.com.

Thank you for taking the time to read this. God Bless!